More Bad News For Injury-Riddled Barbaro Sharons Saddness,Barbaros Surgery was at the same time: We Seniors in the Winter of our years, must live Day by Day

Have Fun Life has just begun."Judge not, and ye shall not be judged." Luke 6:37 - The Holy Bible

Smoking Gun Silver Bullet Senior Queen Sharon Anderson-

Bill Dahn aka Perrault- LeClair of Indian decent, are claiming re: Land Patent Act, Chain of Title, both are of good Moral Character and have ECF and Pacer Accounts.

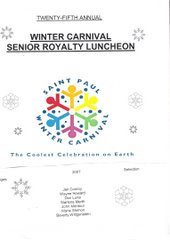

gives legal notice to www.winter-carnival.com to complete the Background checks as required for the Senior Day Nominations: Senior King and Queen are "tainted" by wilful neglience without full disclosure. www.sharonanderson.org

Judges: Don Luna, Bev Wittgenstein,Jan Conroy, Wayne

Howard,Marlene Merth, John Montour, Marie Shimon

cannot render an impartial, unbias Judgment without Background Checks.

Sharon and Bill lay claim to certain parcels of propertys Bill Dahn

claim is 145 Water Street from the 1952 Floods now known as Harriet Island.

MaryDahn1952Flood s/ Bill Dahn tel: 651-453-1992 PO Box 7417 ECF#P1291866 Ojb-Sioux#408B19111http://www.billdahn.com/ http://www.billdahn.blogspot.com/

Sharons historic 1058Summit_Tax2007 with Tenants in Common her Parents Bill & Bernice A. Peterson Intestate Decedants, 6 unit 325 N. Wilder, Duplex's 448 Desnoyer,2194 Marshall,697 Surrey St. Paul, Gun Lake Aitkin, Buck Lake Nashwauk, Gull Lake Brainard, Fee Simple Absolute.

verily allege they are victims ofDeter. Detect. Defend. Avoid ID Theft, Fraudulent Conveyances, False Medical Records, Theft by Swindle by City and County officials to Quiet Title to Realestate which Background Checks must clear , Bill Dahn withdrew , 1/2 Indian the reprisals are pervase/fatal.

THEREFORE: CANDIDATE CHALLENGE.

LEGAL NOTICE: document's are based on SEC filings, current events, interviews, press releases, and knowledge gained as financial journalists, Private Attorney Generals, Candidates for Public Offices, and may contain errors. Investment decisions should not be based solely on these documents Bio for Sharon Anderson , expressly forbids its writers from having financial interests in securities they recommend to readers, affiliated entities, employees, and agents an initial trade recommendation published on the Internet, after a direct mail publication is sent, before acting on that recommendation. TAKING DL_AOL Journal Candidate profile www.blogitbabe.blogspot.com

Senior QueenCandidate2007 Legal Eagle SharonAnderson 1 Journalism Ethics Blogger: www.judicialdelusions.blogspot.com 1986 Petition Jane Duchene MN Bull SharonScarrellaAndersonUSBriefs - Buzznet Photo Sharing Community Sharon'sFedCases1973to2006_13pdf Anderson + Advocates www.sharonanderson.org www.sharon4anderson.org www.alicekrengel.blogspot.com www.sharonscarrellaanderson.blogspot.com

Senior QueenCandidate2007 Legal Eagle SharonAnderson 1 Journalism Ethics Blogger: www.judicialdelusions.blogspot.com 1986 Petition Jane Duchene MN Bull SharonScarrellaAndersonUSBriefs - Buzznet Photo Sharing Community Sharon'sFedCases1973to2006_13pdf Anderson + Advocates www.sharonanderson.org www.sharon4anderson.org www.alicekrengel.blogspot.com www.sharonscarrellaanderson.blogspot.com

SUBMITTED IN GOOD FAITH FOR CARNIVAL FUN.

For educational VA purposes: www.cpljimanderson.blogspot.com

For educational VA purposes: www.cpljimanderson.blogspot.com

1058SummitSharonLegalDomicile From: Sharon4Anderson@aol.com

Date: Fri, 26 Jan 2007 10:43:02 EST

Subject: Commerce realestate Fraud

To: bbonner@pioneerpress.com, bdavis7843@yahoo.com

CC: jbjorhus@pioneerpress.com, mami2fine2004@yahoo.com, rbjohnson@yahoo.com,

Sharon4Anderson@aol.com, Bill4Dahn@aol.com

Date: Fri, 26 Jan 2007 10:43:02 EST

Subject: Commerce realestate Fraud

To: bbonner@pioneerpress.com, bdavis7843@yahoo.com

CC: jbjorhus@pioneerpress.com, mami2fine2004@yahoo.com, rbjohnson@yahoo.com,

Sharon4Anderson@aol.com, Bill4Dahn@aol.com

More investigators will target fraud BY JENNIFER BJORHUSPioneer PressThe state Commerce Department is planning to beef up its team of real estate investigators amid rising concerns about pervasive mortgage fraud and predatory lending.

In the two-year state budget he proposed Monday, Gov. Tim Pawlenty requested an extra $600,000 a year for the department to hire three more real estate investigators for its Market Assurance Division, bringing the number of real estate investigators to 10.

The extra staffing addresses "the growth in the level and complexity of fraud in the housing area," according to the draft budget released Monday. The 47 pages of highlights accompanying the budget said the new staffing "will help address some recent concerns about questionable lending practices and the recent increase in foreclosures."

The $600,000 also will pay for four additional investigators to establish a new Commerce unit targeting elder fraud in financial services. That unit will not focus on real estate. The $600,000 would come out of the state's general fund and be offset by raising the cap on mutual fund securities filings.

Brokers and Realtors applauded the effort to bolster oversight of the mortgage industry.

"We are totally supportive of this proposal," said Patrick Martyn, executive director of the Minnesota Association of Mortgage Brokers. Martyn said that the industry has been in need of greater regulatory enforcement for real estate transactions "for some time."

Glenn Dorfman, with the Minnesota Association of Realtors, agreed.

Autumn Lubin, president of the Minnesota Mortgage Foreclosure Prevention Association, said she is encouraged, but isn't sure the budgeted additions are enough.

"The mortgage and real estate industry has been moving fast as flames the last several years and with budget restraints, the Department of Commerce was relegated to using water pistols to put out the blaze," Lubin said.

In December, as part of a series of articles about rising foreclosures, the Pioneer Press reported that consumer complaints were languishing at the Commerce Department in part because of a swamped and understaffed real estate team. At one point last fall Commerce had just five real estate investigators juggling an average of 210 open cases each.

Sheriffs' sales of homes have more than tripled since 2003, and 7,076 homes were auctioned off last year. Experts point to loose regulation in the mortgage and real estate industries as one, but hardly the only, factor in rising foreclosures.

They describe a virtual toxic stew of factors behind the surge: flattening home values, loose underwriting standards, the proliferation of risky exotic mortgages and explosion of more-expensive subprime loans, abusive mortgage lending, excessive home refinancing, financially unsophisticated borrowers and payment shocks from the interest rates on adjustable rate mortgages resetting.

Commerce regulates the state's real estate agents, mortgage originators and home appraisers, controlling some 42,323 licenses. Its team of real estate investigators responds to written complaints people make about perceived fraud or other trouble in housing-related transactions such as over-appraising home values. There were 2,024 such complaints filed with Commerce last year, up from about 1,300 in 2005.

The additional staffing money was all of what Commerce Commissioner Glenn Wilson asked for, said Commerce spokesman Bill Walsh. Wilson had been planning for some time to hire more real estate investigators, he said, but couldn't do it earlier because of the state's two-year budget process. Commerce won't hire the proposed new investigators until the state Legislature approves the budget and it goes into effect in July, he said.

Commerce plans soon to introduce legislation that would rework the way it licenses mortgage industry professionals, including establishing a net worth requirement for individual mortgage brokers.

Following guidance issued by federal banking regulators last September, Commerce recently tightened its lending guidelines on exotic, or nontraditional, home loans such as interest-only mortgages. Among other things, the new state guidelines urge mortgage originators to fully consider a borrower's ability to repay the loan and to rely on a credit score, and to ensure the risks of mortgage products are clearly spelled out to borrowers.

The guidelines don't carry the force of law, but Commerce warned it will scrutinize how mortgage originators manage the risks of nontraditional mortgages. At issue are such products as interest-only mortgages and so-called option ARMS — adjustable rate mortgages that give borrowers the option of making very minimal payments that don't even cover interest due on the loan and actually result in increasing the mortgage debt.

Also, Attorney General Lori Swanson on Jan. 18 announced far-reaching legislative changes to crack down on predatory mortgage lending, saying she thinks abusive practices and fraud have played a significant role in foreclosures.